Positioning Your Medical Aesthetics Practice For Acquisition

Updated: Oct 15, 2023

The steady double digit growth rate of the Medical Aesthetics Industry and its apparent resistance to recessionary forces has drawn the attention of investors. In the lifecycle of business, the industry appears to be pushing through the early stages of adolescence, solidifying demand for the services and products offered and subsequently establishing itself as an industry with staying power. As such, the industry is at a point where consolidation is inevitable.

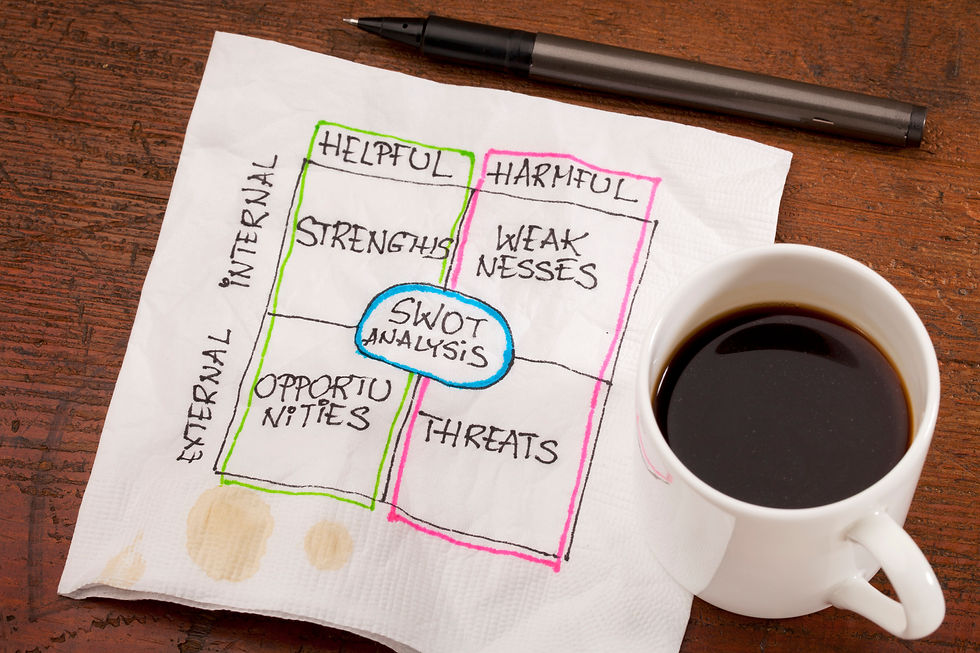

Knowing this, independent owners should begin to position their practice for an eventual acquisition or partnership. Owners should think through their practice’s strengths, weaknesses, opportunities, and Threats (risks) and begin to strategize how to best position the business for investor due diligence activities. To a founder, due diligence can feel as invasive as a full body scan and search by TSA. Little will go unnoticed and untouched. However, owners can position their practice to be as attractive internally as it may appear externally.

How the practice presents itself to the outside world may be the reason an owner receives initial interest from an investor. However, that is one of many factors an investor will consider. Think of it like you would when looking for a life partner. The initial attraction may have been what’s on the outside, but what withstands the test of time is the attraction found on the inside. In this case, the inside attraction looks like profitability, financial stability, established operating systems, strong management, etc.

Practice owners can begin to position their practice for acquisition or partnership by taking an honest accounting of all aspects of their business and developing an action plan for improvement. By doing so practice owners can be prepared in advance for a potential opportunity.

Below is a worthwhile team activity that can help practice owners uncover improvement opportunities, as well as a few areas every practice owner should consider evaluating.

Strengths, Weaknesses, Opportunities, and Threats (SWOT) – Conduct a SWOT brainstorming session with your team. Strengths and weaknesses are somewhat obvious. However, everyone must be honest and constructively critical. For example, customer service may come up as a strength, but when Google is telling the world that your practice has garnered a 4.0 rating out of 250 reviews, customer service as a strength needs to be questioned. An example such as this would more likely fall under the weakness category. Opportunities represent those areas that could be developed to further enhance and grow the practice. Threats are those things that have potential to disrupt or derail the business.

Financial Reporting – The financial records for the practice need to be organized, historical, accurate, and a true representation of the financial health of the business. At a minimum a monthly income statement (P&L), cashflow statement, and balance sheet stretching back three years will be needed. It is also important to know how the accounting is being conducted. Is it accrual or cash basis? Cash basis accounting is most likely the method many small businesses use. However, accrual is the preferred method for business. That said, there are good reasons for choosing cash basis accounting. Know what they are and why you chose one over the other. The goal here is clear and accurate representation of financials. Doubt about the accuracy of the financial reporting can be a deal killer!

Operating Systems – Evaluate your processes and look for opportunities to formalize them. Everything from answering the phone to responding to emails and text messages to how you onboard a client to how you sell products to how you perform each service to how you hire and train new team members, etc. should be backed up with a documented procedure. If it matters to the business, it needs to be formalized. However, you’ll want to keep it simple Complex systems can lead to implementation failure.

There are many aspects of the business that investors will want to learn more about. By being well prepared you can not only increase interest but increase the likelihood of receiving an offer you can get excited about. You will also increase the odds of finding the right investment partner if that is what you are looking to achieve.

Randy Stepp is a principal with Renaissance Leadership Group. RLG is a full-service medical aesthetics practice development company driven by Purpose, Passion, and Strategy and the goal of helping entrepreneurs realize their vision for their business.

Visit Renaissance Leadership Group at www.renaissanceleadershipgroup.com to learn more.

Comments